Experience

As a C++ developer with a deep background in finance and quantitative modeling, I combine technical precision with domain expertise. I’ve spent years building, teaching, and optimizing C++ solutions for complex financial problems—everything from derivative pricing models to performance-critical systems. Whether you’re developing a trading tool, risk engine, or simulation framework, I bring hands-on experience and a results-driven mindset to every project.

Expert C++ Developer for Financial Systems

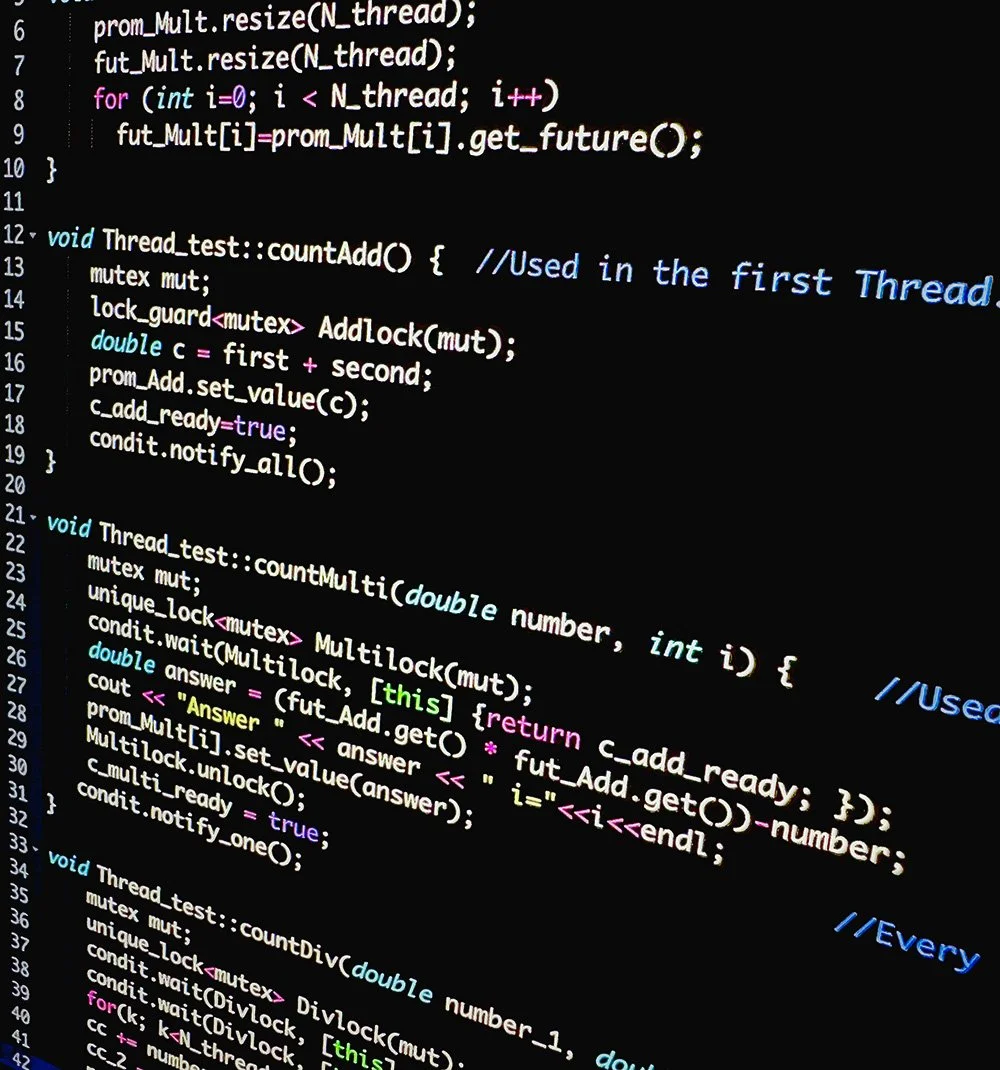

I specialize in developing high-performance C++ applications tailored to financial environments. My work focuses on building fast, reliable models for pricing, analytics, and risk management. With solid experience in C++, I’ve worked on everything from custom data structures for concurrency to algorithmic pricing engines. Whether it’s optimizing performance or solving complex numerical challenges, I bring both depth and precision to every project.

Real-World Option Pricing in C++

I created and led an advanced seminar on option pricing using C++, where I walked finance professionals and graduate students through a 618-line custom codebase that included class design and full pricing functionality. The model demonstrated how C++ can drive real financial insight through hands-on implementation. My ability to translate theory into code makes me a strong partner for clients needing fast, functional tools for pricing and risk.

C++-Driven Course Development for Finance

In my academic roles, I’ve designed and implemented C++-based modules that train future financial professionals in real-world coding. I introduced exercises where students built binomial tree models from scratch, simulating actual trading desk logic. This blend of finance and software development reflects my core strength: delivering tools that not only work but elevate decision-making.

Example Project

Built an option pricing code based on Brien-Jones and Neuberger’s option pricing model published in The Journal of Finance April 2000 pages 839-866. Precented at a seminar at the University of Halmstad Sweden.